Is bitcoin a good store of value? Can it be considered digital gold?

Bitcoin could be a useful tool in helping investors insulate their portfolios from any failure to manage these problems effectively. There are significant shifts taking place in monetary, fiscal, and trade policies around the world that will likely impact global markets well into the future. While we don’t know when or at what levels the current drawdown will end, it is clear that the challenges faced by politicians and policymakers will be difficult to manage given the complexity of our global financial system.

Bitcoin > Gold

November, 2020

Deutsche Bank analysts said customers increasingly prefer bitcoin over gold as a store-of-value investment. “There seems to be an increasing demand to use bitcoin where gold used to be used to hedge dollar risk, inflation, and other things,” said Jim Reid, managing director, head of global fundamental credit strategy, as quoted by ZeroHedge. Bitcoin is up 144% on the year, and gold 22%.

How Will Bitcoin Play Into Global Markets in 2020?

September, 2019

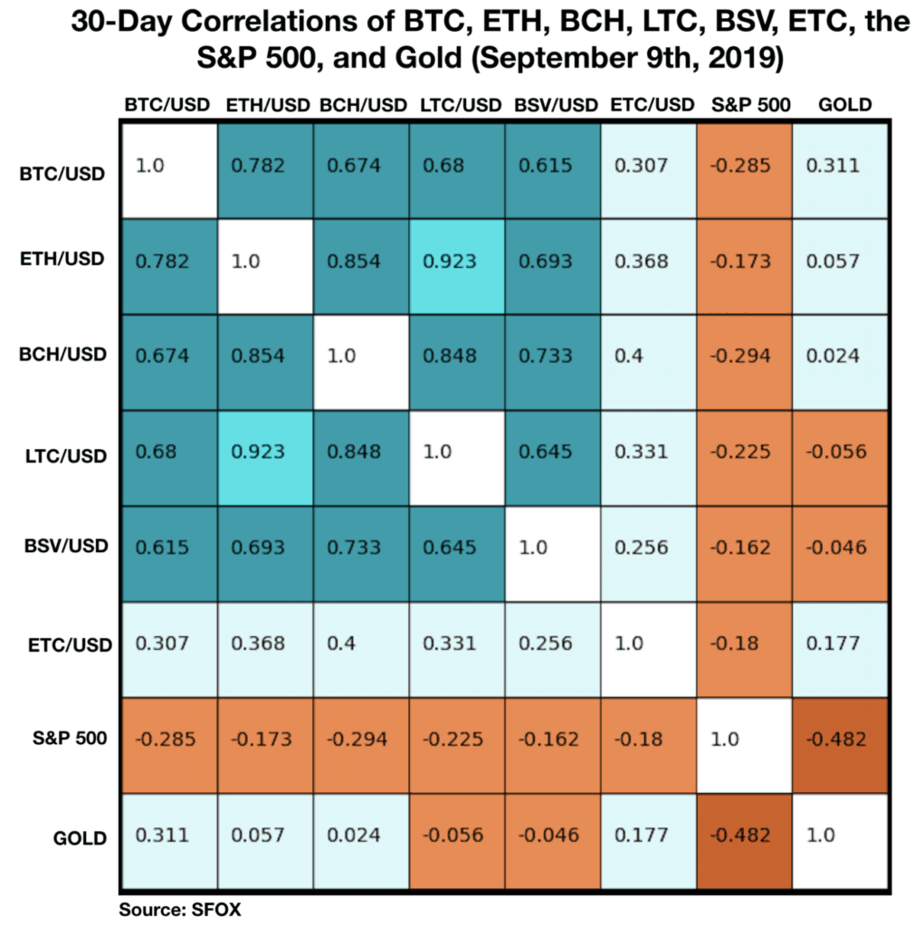

Bitcoin and other cryptocurrencies are continuing to grow and be valued in a way that appears largely uncorrelated with both the S&P 500 and gold, the latest Sfox report reveals.

Bitcoin Is Not a Safe Haven Yet. So, I’m not so sure that it’s a safe haven asset yet, but I do think that it’s starting to act like one. I think that people are starting to portfolio manage, are starting to come in slowly. And when the market is getting shaky you saw Bitcoin rise, I mean, you wouldn’t see that before, it was trading like a risky asset.”

Nelson Minier, Kraken OTC Head

Hedging US-China Trade Risk with Bitcoin

August, 2019

Cryptocurrency asset management firm and Digital Currency Group subsidiary Grayscale Investments has published an updated version of its Hedging U.S.-China Trade Risk with Bitcoin report.

In the 14-page report, Grayscale places the trade tensions between the U.S. and China in a broader context, before exploring the role bitcoin could potentially play in a portfolio exposed to a would-be global liquidity crisis. Grayscale – run by Barry Silbert – maintain $3 billion in assets under management (AUM).

Investors may be Using Bitcoin as a Hedge

July, 2019

We may be seeing broader macroeconomic uncertainty affect the market’s outlook on the crypto sector at this juncture. Data have suggested for months that investors may be using bitcoin as a hedge against global markets. With many uncertain about the impact of rising tariffs and global currency instability on the market, it may be the case that traders are equally unsure of crypto’s future.

Amidst renewed attention from the President, the Senate, Congress, and the IRS, bitcoin has climbed to its highest level of dominance since April 2017. New SFOX research has uncovered market correlations and returns data suggesting that bitcoin is finally coming into its much-discussed role as a store of value and safe haven in turbulent markets. Notably, all of these crypto-assets were more negatively correlated with the S&P 500 than gold was. In light of this, traders may increasingly be viewing cryptocurrencies, especially bitcoin, as a hedge against global markets — perhaps even more so than gold.

Bitcoin might be the greatest store of value in the history of the world. Yes, it’s volatile — as it’s only been useful for about seven years — but its ‘unconfiscatability’ property is unmatched. That is its true store of value, as gold is confiscatable and all other assets even easier.”

Changpeng Zhao, CEO of Binance

Related Reading

- What Gold’s History Teaches Us About Bitcoin As A Store Of Value [Forbes]

The most compelling use case for bitcoin today is as a store of value. But too often, people dismiss the idea because of Bitcoin’s volatility.

[draft]