A bitcoin savings account is a place to safely deposit coins to earn interest or save for the future. It is especially useful if you plan to use bitcoins later. If you expect bitcoin value to increase, the right place to store your coins is in one of the crypto lending accounts, a sort of a crypto bank. While you hold your bitcoin, you should look for ways to earn interest on it. We list several ways to make interest on your bitcoin holdings so that you can choose the best bitcoin savings account. Also, if you invested in bitcoin cloud mining, you can point your newly generated bitcoins to deposit directly into your savings account and earn even more. Bitcoin has become the crypto reserve currency.n

CoinLoan Crypto Interest Account

CoinLoan, an Estonian company, also launched a cryptocurrency loan service. Let your assets work for you with CoinLoan Interest Account. First, deposit your assets to earn up to 10.3% APY. After, watch your savings grow.

If you’re planning to convert some fiat to take advantage of high-interest rates, we recommend choosing USDC or USDT stablecoins to earn maximum interests. And the best part is, you can withdraw your assets whenever you need them, without losing earned interest. The minimum investment period is one day. The maximum period is unlimited.

Ledn – Earn interest on BTC & USDC

Ledn offers savings account for your crypto with monthly compounding interest payments!

We really like Ledn as it is incorporated under the Federal Laws of Canada and is the first digital asset lending company to complete a Proof-of-Reserves attestation by a top-25 public accounting firm. Ledn clients can anonymously verify that their assets are included in the periodic reports. They also provide an amazing weekly newsletter.

Nexo – Earn Passive Income from Stablecoins

To earn passive income from your crypto holdings is to deposit your stablecoin to Nexo platform (you have to change your bitcoin to some of the stablecoins). They act as an intermediate between loan lenders and borrowers. You earn up to 12% yearly interest on your crypto assets.

Your funds are fully secured, and there is a minimal risk involved (they hold 200+% of the face value of their assets as collateral, making Nexo extremely resilient to severe stress across the financial system). You can deposit and withdraw at any time—interest compounding daily, starting from the first day. Nexo Token Holders also receive dividends. Find more info on where to easily exchange bitcoins and buy some stablecoins.

Nexo is the largest and most trusted lending institution in decentralized finance at the moment.

Earning Interest on USDT, BNB or ETC on Binance

The world’s leading cryptocurrency exchange Binance launched a Binance Lending business for customer deposits that initially supports tether (USDT), Binance Coin (BNB), and Ethereum Classic (ETC). Binance users can grow their funds by earning interest income for lending out their holdings over a specific time. Loans carry a two-week fixed maturity with annualized interest rates of 10, 15, and 7 percent, respectively. More Binance Lending products would be released soon.

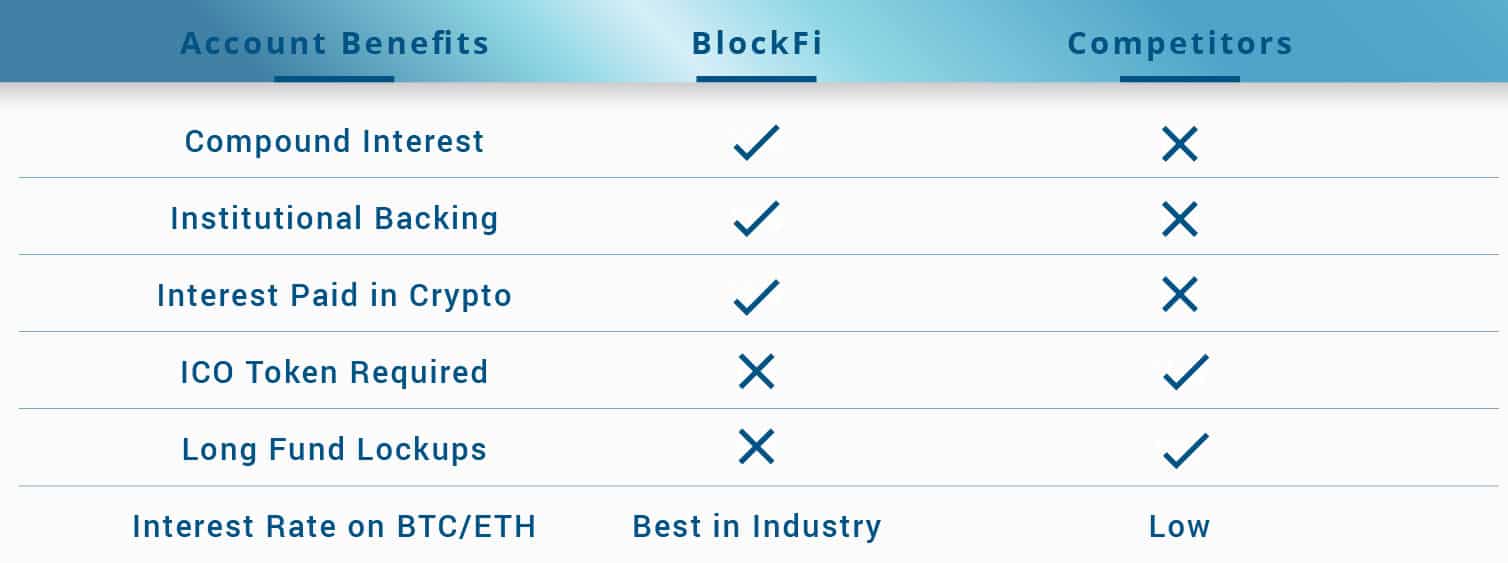

The BlockFi Interest Account

BlockFi is a platform that offers cryptocurrency backed loans. The BlockFi Interest Account (BIA) lets you earn compound interest on various cryptocurrencies, including stablecoins.

Simply store your crypto at BlockFi and earn interest paid out in cryptocurrency every month (interest payment day is always the first business day of the month). Clients holding BTC, ETH, GUSD or other crypto in their account can select to have their compound interest paid out in one of the offered currencies. For example, if you have BTC in your interest account, you can choose to receive all your interest in ETH. This is an excellent way to diversify your cryptocurrency portfolio without having to buy any new crypto. If you are into buying crypto, you can also deposit USD via ACH and use Instant Bank Transfers. There is one free withdrawal per month only.

Crypto.com Savings Wallet

This wallet also provides instant and secure crypto loans. That is why their Crypto Earn service offers liquidity providers to earn up to 18% p.a. (per annum) on various coins, including BTC, ETH, XRP, BNB, EOS, Tether, etc. Interest accrues daily and is paid out weekly in the coin deposited with flexible, 1-month, or 3-month terms available. Earn more by staking at least 500 MCO (their token)!

They have secured coverage for up to US$100 million in insurance for digital assets in cold storage from a global leader in protecting customers’ assets to safeguard against theft or direct loss (100% of our customer’s digital assets are stored in cold storage, that is why withdrawal fees are high).

Eric Schmidt, CEO of Google

“Bitcoin is a remarkable cryptographic achievement and the ability to create something that is not duplicable in the digital world has enormous value.”

Earn Crypto Up To 12.7% a Year at YouHodler

At YouHodler you earn Bitcoin (BTC), Pax Gold (PAXG), USD Coin (USDC), True USD (TUSD), and more. Turn your cold assets into hot profit instantly by depositing crypto in your wallet. Crypto interest earnings are deposited directly into your wallet every week. Earn 12.7% interest on USDT!

This platform looks nice and it provides some services that other providers don’t. However, the company lacks any kind of insurance and therefore should be considered risky. What we like is that they integrated Binance Smart Chain (you can deposit and withdraw your crypto with the lowest fees on the market).

Bitpanda Crypto Index

Diversify your portfolio by investing in the Bitpanda Crypto Index. Instead of getting lost in a jungle of different assets, you can invest in the top 5, top 10, or top 25 cryptocurrencies and have the peace of mind of not missing out on anything. That’s because each index gets rebalanced automatically once a month.

You can also create your personal savings plan within minutes! Let’s be honest: guessing when it’s the right time to buy and sell can be difficult for everyone, let alone beginners. That’s why we think a savings plan from Bitpanda is great! It removes the guesswork from investing and only takes a few minutes to set up. With a savings plan, you can quickly and easily buy bitcoin and more digital assets over time and benefit from the cost averaging effect.

USDC Savings With 4% APY at Coinbase

Nasdaq-listed cryptocurrency exchange Coinbase is rolling out a cryptocurrency savings product allowing its users to earn 4% annual percentage yield (APY) lending out their USDC coins.

The savings product isn’t FDIC- or SIPC-insured and works the same way numerous other cryptocurrency lending products do, with some offering up to 8% a year. Coinbase’s offering has a comparatively lower yield because it won’t lend to “unidentified third parties.”

Coinbase, which administers the USDC stablecoin in partnership with Circle through the CENTRE Consortium, has claimed the offering is safe. Its eligible users in the U.S. can now pre-enroll for the product.

Earn up to 17% at Celsius Network Account

Earn big rates on any amount of crypto! Simply transfer your currency to Celsius and earn up to 17%.

Customers entrusting their coins with Celsius Network earn whenever they move their assets to their respective Celsius Wallet in an app. Celsius Network gives 80% of total revenue back to the community of depositors each week in the form of interest income. If you hold their $CEL tokens, you get a better interest rate (this is optional). If your coins aren’t earning up to 10.5% annually, you’re missing out on your fair share of the profits. They also provide loans business for one of the biggest crypto exchanges, Bitfinex.

Other Platforms & Offers

Unreviewed, use at your own risk!

- Gate.io: a blockchain assets earning platform which facilitates stable earnings for your cryptocurrency investment, offering various financial products, including term (lock-up) and non-term earning products among others. Earn 9% P.A. for staking USDT, which correlates to 0.025% per day.

- You can earn all sorts of rewards on your crypto at Kraken. You can also make money on parachains (parachain slot auctions take advantage of Polkadot and Kusama’s ability to give developers ways to create new crypto assets and decentralized applications (dapps) on top of its blockchain).

- Users of the Luno cryptocurrency exchange can now earn passive income on bitcoin holdings through the firm’s new savings wallet. The interest rate is variable and transfers out can take up to 7 business days. Interest is paid out monthly.

- Earn solid returns up to 8.45% with Nebeus Crypto savings account. Invest in Secured Bitcoin Loans. The monthly interest is automatically credited to your wallet. Withdraw your profit whatever you want, no delays — just a couple of clicks. The platform looks nice from the outside but is quite buggy, and we do not recommend them right now.

Other Ways to Earn Interest on Your Bitcoin Boldings

- You can lend money to bitcoin traders at some bitcoin trading platforms and get paid interest for that. Many providers offer leveraged trading, this is when a trader seeks to increase their potential profit (or loss) by borrowing additional coins. See Liqui or Bitfinex (margin funding) for example.

- You can also lend money on other bitcoin and crypto lending platforms and get interest for doing that. Compared to savings account described above, rewards are much higher and so are the risks of not getting your money back (only on P2P lending platforms)! See our bitcoin loans guide for details.

- Compound interest is interest that is added to the initial investment, or principal of a deposit, so that the investment plus the added interest also earns interest from then on.

- We maintain deposits at all service providers above. It means that all providers above are regularly paying interest.

- Your BTC savings wallet is not a traditional fiat currency bank account, and cryptocurrency accounts are not covered by deposit protection insurance.

- How about saving some bitcoin for retirement in a bitcoin IRA?

- Please check also other bitcoin money making opportunities.

GOOD JOB,GO A HEAD,GOOD LUCK

I don’t know about your case, but it certainly works for us. We recently added funds and removed them and it works fine.

want to join but captha always just goes next captha I understand its an outsouce its not working ?

I tried Magnr, it was easy enough for my mum to understand so that’s where I get her to put her coins. Haobtc and companies based out of china sometimes pay more interest but the risk is higher.

What is the minimum deposit? Can I deposit 2 bitcoins?

Emmanuel, it seems that there is no minimum, just deposit whatever you have and make money.

Did you try your spam inbox? Sometimes mail ends up there if you haven’t whitelisted their addresses.

how can I take my account?

Just signup and send bitcoins and you are done.

We have 5 bitcoin and we currently get 0.00971042 monthly.

Hi ive recently joined twice but i cant deposit my funds because i have notice you only allow credit cards what if one doesnt have a credit card and badly wanna start trading and making money cause my family is struggling with the little i make so far and i have a loan that is overdue

I want open bitcoin saving account online, how can I go about it

cloudflare are denying me access to my bitcoin saving account ,please help to be rid of cloudflare

What’s the best bitcoin saving wallet with high percent rate of interest and can be trusted?

My vote goes to Nexo!

I like it