Currently, we have two types of cryptocurrency exchanges: centralized (most of them) and decentralized exchanges (DEX, just a few). Although people are excited about the development of decentralized exchanges, this technology is still in the early stages. It may take a few years until it makes a significant impact on the cryptocurrency industry. However, some platforms that are worth noting already exist (see the list below).

Are you are afraid of the safety of your cryptocurrencies on a centralized exchange? Then the decentralized platform for exchanging crypto assets might be the right thing for you. Centralized exchanges are popular targets for hackers since they store user data (passwords, emails, and other personal data). On the contrary, decentralized exchanges run over several nodes, and they can better absorb a security breach.

It is good to know about decentralized cryptocurrency exchange for the added safety of your funds.

Decentralized Exchanges List

List of Top 5 Decentralized Exchanges

- Uniswap: the larget decentralized exchange at the moment is Uniswap. It is a decentralized protocol for automated liquidity provision on Ethereum. The UNI token is the governance token of the Uniswap (it has seen a parabolic rise since its launch). Uniswap empowers developers, liquidity providers and traders to participate in a financial marketplace that is open and accessible to all.

- SushiSwap: after becoming the world’s highest-volume DEX within less than 18 months of launching, Uniswap recently faced an existential threat with the launch of a SushiSwap, a Uniswap fork which introduced decentralized community ownership via its governance token, SUSHI. It is an automated market making (AMM) decentralized exchange (DEX) currently on the Ethereum blockchain. Unlike other protocols, SushiSwap is a community run project that is governed by vote of the community.

The SushiSwap decentralized exchange has had an adventurous journey to get to where it is today. From the early days, the platform was riddled with controversy about the project’s abandonment by its anonymous creator. Then came an explosive rally in the SUSHI token catching everyone’s attention as the community took more control over the project. - Curve: DeFi exchange Curve Finance is seeing explosive growth. There are 7 coins and 20 trading pairs on the decentralized cryptocurrency exchange. The most active trading pair on Curve Finance exchange is USDT/USDC.

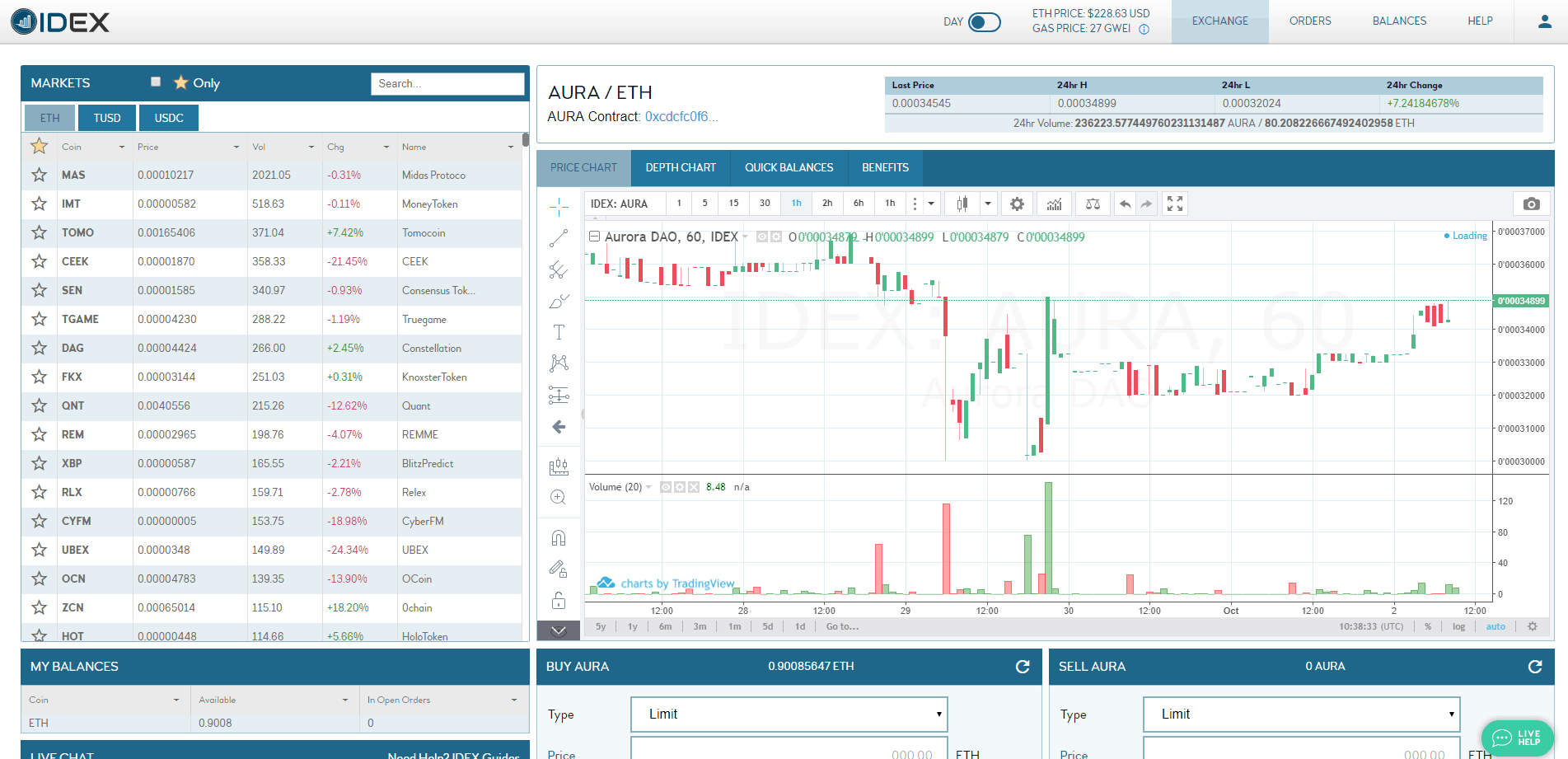

Besides its surging activity, another interesting aspect about Curve is its mysterious roots. The website lists no official team members. CurveFinance was forced to transition into a decentralized autonomous organization after an anonymous developer front run and deployed smart contracts on the platform without informing the Curve development team. The developer then tweeted that CurveDAO was ready to launch, and soon after, the whole idea gained traction. The core development team of Curve Finance was skeptical at first but later on, adopted the idea. - IDEX: IDEX

is hybrid-decentralized exchange. The smart contract is used for trade, custody of funds, and settlement. While the servers manage the order book, balances, and trade dispatching. Detailed coordination of the two is what creates the real-time trading experience, however this coordination relies on a centralized infrastructure. Most of the trading happens with Ethereum. Currently the top DEX by volume.

is hybrid-decentralized exchange. The smart contract is used for trade, custody of funds, and settlement. While the servers manage the order book, balances, and trade dispatching. Detailed coordination of the two is what creates the real-time trading experience, however this coordination relies on a centralized infrastructure. Most of the trading happens with Ethereum. Currently the top DEX by volume. - EtherDelta: EtherDelta is not a centralized product or organization. It is an open source solution available on GitHub. This decentralized trading platform lets you trade Ethereum and ETH-based tokens directly with other users. A popular use for this exchange is to convert ICO tokens into ETH. You are solely responsible for your account, funds, trading decisions and private keys. An exchange does not hold your funds in any way.

List of Other Decentralized Exchanges

- Balancer is an Ethereum-based automated market maker (AMM) that’s somewhat similar to Uniswap. The Balancer decentralized finance protocol features a diversified governance structure where the Balancer Protocol Governance Token (BAL) is used to align the interests of token holders and protocol stakeholders.

- ParaSwap makes swapping easier, faster and cheaper by aggregating more than 20 decentralized exchanges -or DEX- in a single interface, including Uniswap, SushiSwap, Balancer, Bancor, 0x and many more.

- 1inch exchange is a decentralized exchange (DEX) aggregator to help users discover the best trade prices for tokens. Instead of swapping tokens from a single liquidity pool of a DEX, 1inch will aggregate across different pools and suggest the most efficient way to trade tokens.

- StellarX

is a user-friendly, peer-to-peer marketplace. They are free, fast, and list every asset class. The exchange offers multiple cryptocurrencies from different blockchains as well. Stellar (XLM) is a base currency. All transactions are with no middlemen or intermediaries. You can trade on the Stellar DEX from your own wallet and keep total control of keys and digital assets.

is a user-friendly, peer-to-peer marketplace. They are free, fast, and list every asset class. The exchange offers multiple cryptocurrencies from different blockchains as well. Stellar (XLM) is a base currency. All transactions are with no middlemen or intermediaries. You can trade on the Stellar DEX from your own wallet and keep total control of keys and digital assets. - Bancor lets you convert between two tokens of your choice without any counterparty. Just like an exchange. You can do this while taking advantage of an automatically calculated price. Probably the most liquid DEX right now.

- Bisq (formerly known as Bitsquare) is a p2p (peer-to-peer) marketplace that uses Tor network in order to achieve its decentralized and anonymous status. It currently supports all major cryptocurrencies. In order to start trading on Bisq, users must download the official software.

- Flyp.me is fast and private accountless exchange to trade your favorite cryptocurrencies. No registration, no email, no ID. Only your crypto address.

- Counter is a digital asset exchange platform offering the complete trading experience. Counter uses a hybrid-decentralized architecture to achieve the performance of centralized exchange and the security and auditability of a decentralized exchange.

- Waves Dex exchange provides the best of the two world’s. It gives you control of your funds on the blockchain and accelerates the exchange process by using a centralized matching service. It allows users to trade their coins in exchange for Waves.

List of Decentralized Exchanges in Development

- Synthetix is a payment network with a dual token system to reduce price volatility. This permissionless and stable payment network procvides an option for anyone to transact with anyone. Each transaction generates (low) fees that reward collateral token holders. As transaction volume grows, the value of the decentralised platform increases.

- In most cases, the speed and performance of the DEX you use will determine how much in terms of token allocation you receive. While Uniswap is a market leader, its popularity has often led to network congestion on Ethereum’s blockchain leading to delayed and costly transactions. EasyDEX, on the other hand, features the same automated market-making protocol as Uniswap but transacts at a fraction of Uniswap’s fees thanks to the fact that EasyDEX operates on the Binance Smart Chain.

- Quantadex wants to become the next generation of hybrid decentralized exchange for cryptocurrencies. Security and speed are core functions here, allowing millions of transactions per second. All trading happens on the blockchain, therefore no user data is stored on their servers. They want to create the DEX where the community can contribute to the development and vote over coins listings.

DeFi, the phenomenon of decentralized finance

The rise of decentralized exchanges, or DEXes, represents a new chapter of the recent boom in decentralized finance. The fast-growing ecosystem, known as DeFi, consists of automatic lending and trading platforms, built atop distributed computing networks like Ethereum and constructed from open-source software and programmable cryptocurrencies. They aim to provide more efficient and less costly ways of conducting transactions currently handled by banks and traditional exchanges.

Uniswap, a semi-automated platform for matching buyers and sellers of cryptocurrencies and other digital assets, and other so-called decentralized cryptocurrency exchanges, challenging established venues while driving up fees and congestion on the Ethereum blockchain.

Understanding Decentralized Exchanges

Technicalities of Decentralized Exchanges

A currency exchange works in four ways. These are capital deposits, ordering books, order matching, and asset exchange. Ideally, in decentralized exchange all these functions are decentralized. It means these functions run without the monitoring and regulation of any governing body and federal control. Presently, only the asset exchange run in decentralized manner. The rest of the three functions of current exchanges run in a centralized option. Therefore users are not completely anonymous.

Two types of Decentralized Exchange Models

Currency-centric exchanges run on singular blockchain platforms, such as Ethereum. They are limited to the currency of the platform. For example, ERC20 assets on Ethereum.

The other model is currency-neutral. It links different native cryptocurrencies. It means that users have no obligation to adhere to any precise currency ecosystem. These systems permit users to trade cryptocurrencies without a coin underlying that exchange. Some of the instances of these models include Bisq and Flyp.me.

Advantages of Decentralized Exchanges

- Decentralized servers: these decentralized exchanges are difficult to hack. This is an additional advantage for data and fund protection.

- Not restricted by legal jurisdiction: DEX is not restricted to any specific geo Location. Therefore, it is almost impossible to identify and shut it down completely. Even in the countries where cryptocurrency is banned!

- Privacy: decentralized exchanges allow the anonymous transaction of the crypto users.

- Coin responsibility: DEX permits peer to peer transaction. Hence the ownership of the cryptocurrency stays with the user only.

Disadvantages of Decentralized Exchanges

- They are complicated for new investors: this confusion leads to lesser popularity.

- Anonymous ownership: no identity of the users may get troublesome for a network.

- Not regulated: if there is any transaction issue, it cannot be disputed.

DEX Architectural Significance

Regarding the architecture, decentralization means that the operations under this exchange run without the involvement of a centrally controlled server. At the same time, the nodes of the network are equally distributed. Presently, one of the perfect specimens of a real decentralized exchange is BlockDX. Here all four functions operate in a no–central monitoring way. Recently, EtherDelta is working as a dependable decentralized exchange. We hear that security-conscious digital currency investors are showing their preference for this DEX.

Decentralized Exchanges and Anonymity

Not having one single point of control follows the idea that all people should be responsible for their wealth. They should have the right to operate without the intrusion of governments or centralized authorities. In short, they deserve the ability to maintain their privacy. DEX exchanges are surveillance-free and censorship-resistant without a single entity or person to take control.

Final Words

First of all, the cryptocurrency market is growing globally at a rapid pace. As the downside of the potential crypto market, cybercrime and related criminal activities are common around cryptocurrency transactions. Existing fiat currency exchanges are not compatible enough to accommodate complete safety and the best integration of crypto-transactions. Here decentralized exchanges can bridge the gap. Also, the best part of this type of crypto compatible exchange is in its faster transaction speed and strong security. And finally, all the records remain stored in the blockchain, and tampering with data on a blockchain is hard.

- Please follow decentralized exchanges hashtag on Twitter for the latest news.

- Great analysis: I analyzed 258 decentralized exchanges and this is what I found [october, 2018].

- Decentralized Exchanges only allow “same blockchain crypto-to-crypto” transactions. As a result, allowing a fiat to crypto transaction always needs an off chain operation. Find out more in The Truth about Decentralized Exchanges [october, 2018].

- Decentralized Exchanges Will Keep Growing, Even as Institutions Invest in Crypto. See this report from Cryptocompare [october, 2020]

- Binance, the world’s largest crypto exchange by daily trading volume, is launching a beta version of its decentralized exchange (Binance DEX) in early 2019 [september, 2018].