It has never been easier than today to buy gold with bitcoin and other cryptos. Gold has been an unrivaled store of wealth for many years. That is why more and more people seek the security of gold. Cryptocurrencies are risky, and we think it is wise to put some profits from trading or mining into some solid gold for bitcoin. Gold proved to be a source of capital preservation through the centuries. It is also an efficient hedge against inflation and currency risks.

Pair together the ease and convenience of digital payments with the integrity and stability of gold. Since there have been comparisons between bitcoin and other more traditional commodities, it is quite inevitable to see the emergence of services for buying gold with bitcoin.

Buy Paper/Digital Gold With Bitcoin

Buying gold? Instead of jewelry, invest in paper, digital gold! The term paper gold means you have an online account or a piece of paper acting as a substitute for the physical gold. With paper gold (also digital gold), you don’t own the physical gold. You hold a promise that your physical gold exists in some vault. Buying paper gold is especially convenient if you do not want to deal with gold storage and security. But if a company where you purchased gold defaults, paper gold will be little more than a piece of paper. A bar of gold will always be a bar of gold.

BitPanda

You can buy, sell, and store precious metals like gold and silver directly via the Bitpanda platform. In order to buy, sell and swap digitized gold and silver you will need a verified Bitpanda account. Swap gold and silver with any other digital asset on Bitpanda (including bitcoin, Ethereum, etc).

Bitpanda physically backs the metal tokens. Each token of gold and silver that you buy represents a certain amount of physical gold or silver that is stored and insured in a vault in Switzerland by their partners. When trading gold and silver on Bitpanda, you don’t move it from its physical location. Therefore, it remains inside the vault. You will be buying gold and silver tokens which are backed by physical gold and silver, insured and stored in the secure vault in Switzerland.

There is a premium for buying and selling, as well as a storage fee. Currently, there are no storage fees for your first 20 grams of gold, small amount of palladium and platinum, and 200 grams of silver. Bitpanda is fully compliant with AML5.

OneGold

OneGold is an online bullion marketplace that’s been accepting cryptocurrency payments. The online gold marketplace has been accepting bitcoin, bitcoin cash, ether, and stablecoin payments. OneGold essentially lets users fund their accounts to buy gold and silver, but offers its users a 2% discount if they choose to pay with cryptocurrencies. These payments are supported by BitPay.

U.S. Gold (USG) is a digital representation of investment-grade physical gold, insured, audited, and vaulted in the United States. The precious metals themselves are held at the Royal Canadian Mint, a corporation of the Canadian government, or with APMEX, Brinks or Loomis in the United States. Users’ holdings are “100% redeemable for physical precious metals.” The marketplace is now launching a mobile app that’ll make it easier to buy gold with bitcoin.

Goldmoney

Within a few minutes, you can create a secure, free vault account with access to purchase and hold gold. You can add funds to your account using a variety of deposit methods including cryptocurrencies, bank wire, credit card, PayPal, etc. If you want to buy gold with cryptocurrencies, you must pass the detailed verification process.

The standard option is to own gold virtually. All gold holdings on this platform are backed by fully-allocated, fully-insured, and redeemable gold. Goldmoney currently offers custody with 15 locations around the world (clients can exchange metals between any of their vault locations around the world, but for a 0.5% fee).

Gold purchases, redemptions and invoicing have 3% fee of the official gold spot price (account funding 0.5%, buying and selling with cryptocurrencies another 2.5%). But at any time you have the option to redeem your balance to physical gold.

A useful option is to withdraw your funds to a debit card. This effectively means that you can actually sell bitcoin via gold and receive fiat funds into your debit card (with a lot of fees though).

Vaultoro

Vaultoro is a UK-based platform, offering a real-time bitcoin gold exchange platform to users from all over the world. Exchanging bitcoin and Ethereum for gold and back eliminates any form of volatility for bitcoin users.

If you’d like to own some gold that is stored in Switzerland, buy it at Vaultoro. They will store your gold at Brinks. Brink’s Switzerland is one of the most renowned warehousing companies in the world and one of the largest vaulting facilities in Switzerland. But it will cost you – they have 0.033% storage fee per month. You must pass a thorough verification process on buying gold with bitcoin. Your holdings are 100% insured and audited.

You can verify your gold holdings through proof-of-reserve, as well as proof-of-audit, conducted by third-party auditors. Vaultoro is also a trading platform where you can directly trade gold and bitcoin – bank independent!

They also organize the physical delivery of your gold, but this requires a significant amount of management, and it costs more. Vaultoro was primarily set up as a way for people to easily buy, trade, and sell allocated gold bullion. Gold is secured as your legal property in your name within a professional vaulting facility.

Buy Gold-Backed Cryptocurrency With Bitcoin

Another sector that has been growing fervently is the demand for gold-backed cryptocurrencies and two of these tokens are fetching a premium.

PAX Gold

PAX Gold (PAXG) is a digital asset. Each token is backed by one fine troy ounce (t oz) of a 400 oz London Good Delivery gold bar, stored in Brink’s vaults. If you own PAXG, you own the underlying physical gold, held in custody by Paxos Trust Company. Built as an ERC-20 token on the Ethereum blockchain, PAXG can easily be moved or traded anywhere in the world. For example, you can buy gold tokens with bitcoin on Binance and other exchanges.

XAUT

Tether Limited has issued a coin called XAUT. A single XAUT is represented by “one troy fine ounce of gold on a London Good Delivery gold bar.” XAUT carries a 0.62% premium at the time of publication. It is a digital token, backed by physical gold. The XAUT token can be transferred to any on-chain address from the purchasers’ Tether wallet where it is issued after purchase. Specific gold bar(s) will be associated with each on-chain address where Tether Gold is held. Get it on Bitfinex.

Buy Physical Gold With Bitcoin

In gold investments, physical gold is probably the safest investment way (and the most boring for us too). The investment types of physical gold include gold jewelry, gold coins, gold bullion, and vaulted gold.

Veldt Gold

Veldtgold is an online retailer of various precious metals. Besides gold, you can also buy silver, platinum, and a few others. They only sell real and physical investment-grade gold with options to pay with bitcoin, wire, or check. The fastest way to receive your gold is to pay with bitcoin as this way you do not have to wait for a wire or check to clear.

You can buy gold coins and gold bars. Your gold products will be delivered to you directly via mail within a few days of ordering. They are well-known throughout the online bitcoin community as a reputable gold dealer.

What makes them unique, Veldt Gold makes it easy to get bitcoin for gold and silver. They provide their customers with both sides of the trade. They will buy any of your gold, silver, platinum, and palladium bullion items for BTC at a better price than you will get at the local coin shop.

Money Metals Exchange

MME is one of the fastest-growing precious metals dealers in the United States, and it gets good reviews from bitcoin and other users. This gold dealer does not specialize in bitcoin purchases, but among other payment options allows bitcoin payments and payments with other cryptocurrencies.

They offer a wide variety of gold, silver, and some other precious metal products at some of the lowest premiums in the industry. They provide excellent service with speedy delivery (all orders are shipped within 48 hours after the customer’s payment clears).

Bitgild

This Dutch company is mostly focused on European customers and offers bitcoin to gold conversion. They offer physical gold purchases with bitcoin, like coins and bars. You can pay with other cryptocurrencies as well, like ethereum, ripple, and others.

They have direct relationships with wholesale gold suppliers and mints. With the use of bitcoin as a payment option, they can keep prices fair and shipping costs low. Their prices are up-to-date with the bitcoin markets and live gold prices. We know people who bought gold worth thousands of dollars here.

If your delivery address is within the EU, processing your order normally takes 3-5 working days. They fully insure all shipments. For orders within the EU, they do not require identification for most orders. However, buying extreme quantities will require your identification.

Bitstamp

One of the first regulated bitcoin trading platforms is now offering a method of withdrawing funds in the form of physical gold to their clients. If you already have an account with Bitstamp, the process is straightforward.

Their provider is Moro. Moro is a Slovenian company that also sells gold directly for bitcoin, so it is worth comparing prices. After you place the order, your gold will be ready within 2 to 5 business days. Your fully insured gold shipment has a tracking number. If you want to buy gold with bitcoin in Europe, they have an option to collect your order on the company premises in Slovenia. It is free of charge, and you can do it the next business day after you pay for your order.

They only sell internationally recognized Good Delivery Gold Bars by Argor Heraeus in Switzerland. These are fine .9999 pure gold bars that you can sell to banks and trading companies worldwide based on the spot price of gold. Buying gold bars with bitcoin allows investors to get the maximum amount of gold without unnecessary additional costs.

Schiffgold

SchiffGold is a full-service, discount precious metals dealer specializing in investment-grade gold and silver bullion. It was founded by legendary Peter Schiff (check his Twitter on the recent gold-related news; he also regularly bashes Bitcoin and cryptocurrencies in general, as well as President Trump). We just successfully acquired some gold here.

SchiffGold offers only the most common and popular bullion products (gold coins and gold bars). They do not provide any numismatic and collectible products. After you purchase precious metals, the next step is to keep them safe. They can help you place them in a retirement account, store them in an international vault, or find a home safe that fits your needs.

How is Bitcoin Correlated to Gold

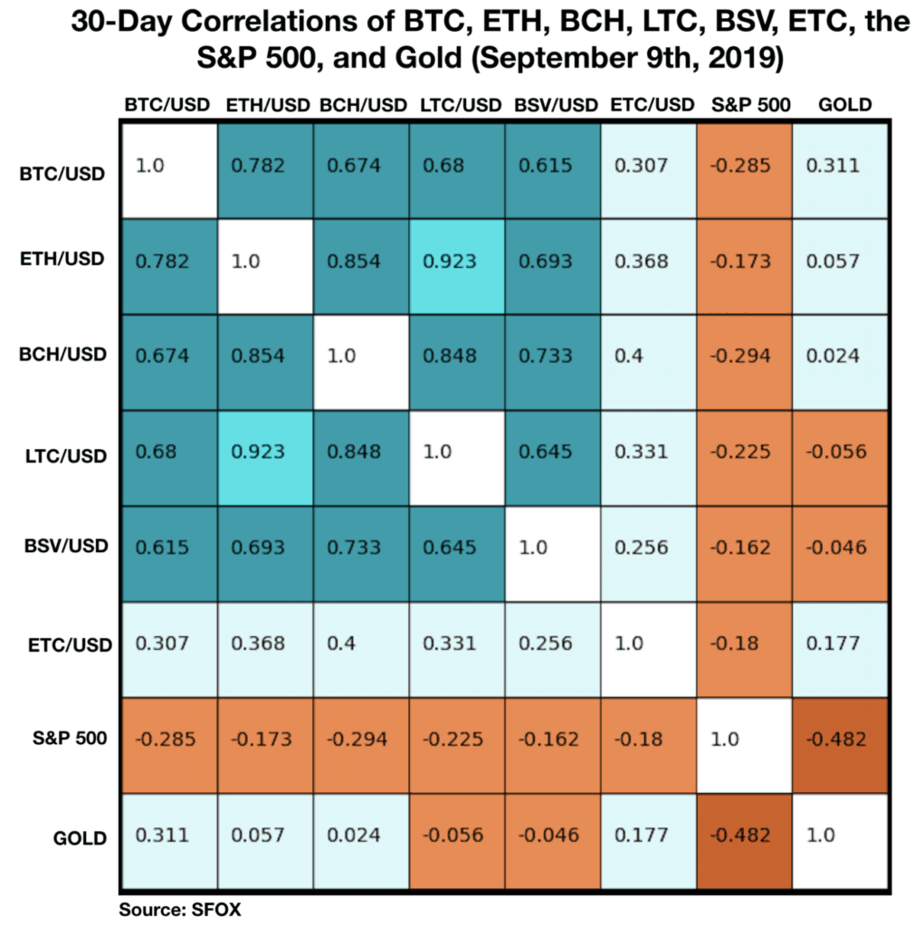

The latest Sfox report reveals that bitcoin and other cryptocurrencies are largely uncorrelated with gold, reinforcing the hypothesis some have made that crypto has unique diversification value in portfolio management.

Related

- Gold, silver, and bitcoin have a finite amount that can be produced, meaning they are inherently scarce. These commodities cannot be artificially replicated. Meaning another entity won’t be able to devalue your wealth by simply creating more.

- Some market data, our beliefs, and recent developments indicate that a lot of people perceive bitcoin as a new safe-haven asset. Investors can resort to bitcoin or gold in times of crisis. In short, it is a genuine competitor to gold. The big difference is the thousand-year track record of gold against just a few years of bitcoin.

- Please check our bitcoin money making opportunities.

Related Reading

- What Gold’s History Teaches Us About Bitcoin As A Store Of Value [Forbes]

The most compelling use case for bitcoin today is as a store of value. But too often, people dismiss the idea because of Bitcoin’s volatility.

Buying Gold with Bitcoin is quite possible, but let’s assume we are buying it from a country far from where they are selling these precious metals. How do we get our hands on them?